Trading with EXAA

"One-Stop Shop" for Your Day-Ahead Spot Trading

EXAA currently offers two Day-Ahead auctions for its market areas AT, DE, BE, FR and NL:

- 10:15 Auction (Classic Auction) – an independent auction providing the first price signal of the day

- 12:00 Auction (Market Coupling) – participation in the European Single Day-Ahead Coupling (SDAC)

With the different auction times and our unique spread products, EXAA is the ideal starting point for optimizing your trading portfolio. This allows you to benefit from arbitrage opportunities between the various Day-Ahead markets.

Access to our trading system is straightforward via web interface or through the Trading API.

-

Due to the early auction time at EXAA within the framework of its own 10:15 Auction, traders receive an important first price signal for the rest of the trading day. This price signal is particularly important for single hours, as these values are difficult to read on the OTC market. EXAA participants also receive an important indication of market developments for the traded block products through the first spot auction in Europe.

The service we offer at a glance:- First spot price reference for the market areas Austria, Germany, France, Belgium and the Netherlands

- Fully integrated and cross-product trading of quarter hours, hours and blocks

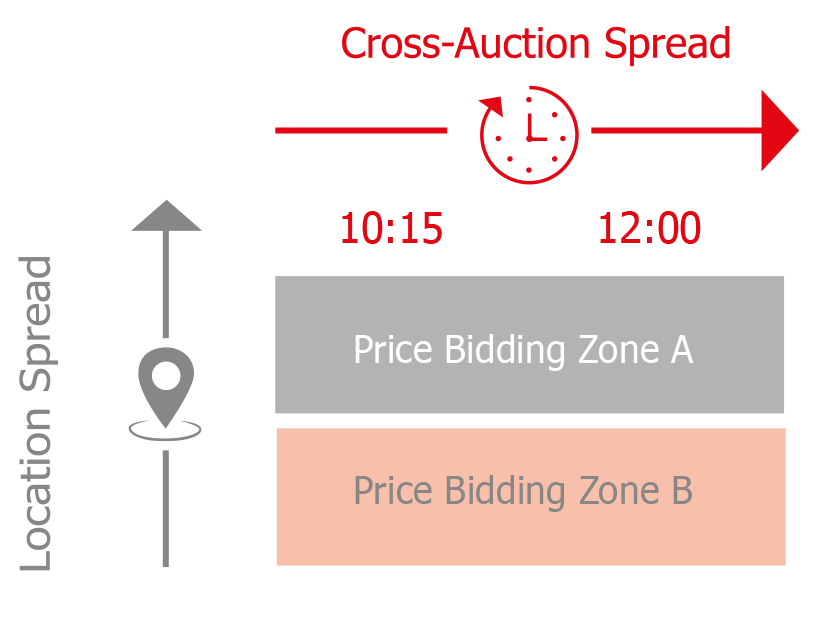

- Extensive optimisation possibilities for your trading portfolio through unique spread products (Location Spread & Cross - Auction Spread)

Location Spread

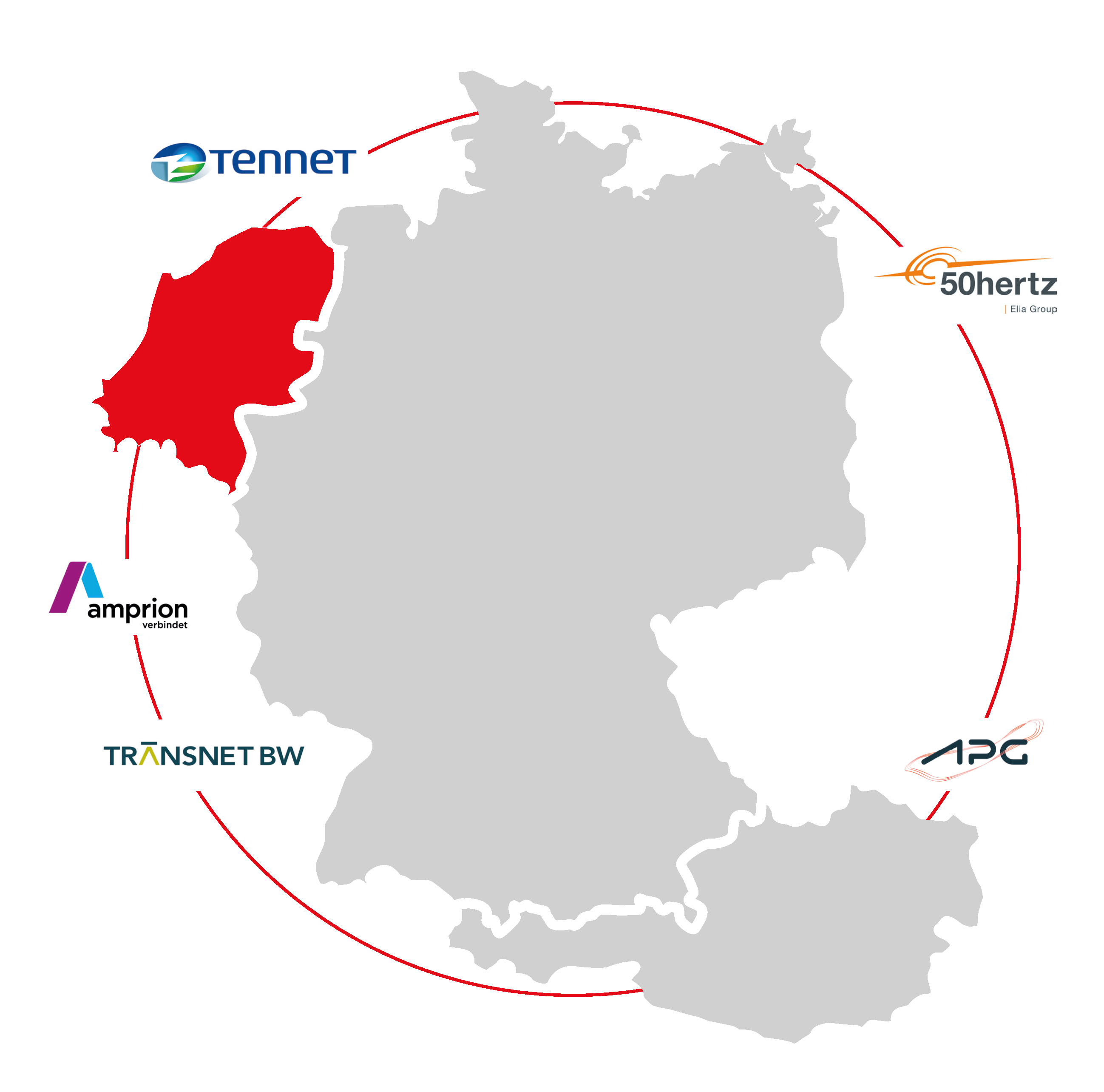

Since the price zone split between Austria and Germany in October 2018, the auction prices for the market areas Austria and Germany are calculated separately. The resulting price differences between the market areas result in cross-border trading opportunities, which can be seen via our innovative Location Spread. The Location Spread thus enables the submission of bids on cross border price differences for the products base and peak. This combines the liquidity of the otherwise separate 10:15 auctions.

Cross-Auction Spread

In addition to the Location Spread, EXAA offers the Cross - Auction Spread as a further option for comprehensive portfolio optimisation. With the Cross-Auction-Spread, it is possible to realise arbitrages for all blocks and hours between the trading profiles of the 10:15 and the 12:00 auction. Our trading participants benefit not only from reduced transaction fees, but also from a low capital investment based on an attractive calculation of trade limits.Trading with quarter hours

Maintaining quarter - hour accuracy in the procurement and utilisation of power generation is a significant issue in the energy industry.

Quarter - hour deviations due to hourly averaging not only cause high balancing energy costs, but also endanger grid stability.

EXAA has therefore been successfully offering its trading participants integrated trading in quarter - hourly products in the Day-Ahead spot market since 3 September 2014.

-

- Day-Ahead market place for Austrian and German hydro power

- Plants registered by sellers are published on the website beforehand

- Coupled delivery of Guarantees of Origin (EECS standard) and physical power

- Guarantees of Origin from EXAA Green Power are a perfect sales instrument when it comes to fuel mix disclosure

- In case orders cannot be executed, they can optionally and automatically be transferred into the grey power spot auction

For more information contact trading@exaa.at.

-

Since July 2, 2019, EXAA has enabled its members to participate in the pan-European Day-Ahead auction within the framework of the Single Day-Ahead Coupling (SDAC) for the market areas Austria, Germany, France, Belgium and the Netherlands.

Service overview:

-

Physical settlement in all control zones

-

Option for physical settlement of futures contracts

-

Efficient collateral management through trade limit calculation based on 10:15 prices

-

Implementation of optimization strategies between the 10:15 and 12:00 auctions (Cross-Auction Spread)

-

Product specification

To enable trading participants to cover their daily demand profile in the best possible way, all 24 individual hours, 96 quarter hours of the respective delivery day and 15 different blocks are defined as individual trading products within the 10:15 Auction. The entry of block bids enables a higher degree of security with regard to uninterrupted trading for several hours.

Within the 12:00 Auction, all 24 individual hours of the respective delivery day, 15 blocks, and (since October 2025) quarter hours are tradable.

The minimum trading quantity is 0.1 megawatt hours. In addition, the quantities can be traded in 0.1 MWh steps. The prices are always entered with 2 decimal places in EUR, which means that the smallest price change is 0.01 EUR/MWh.

Your design options on the EXAA spot market

In order to make the best possible use of your membership in the EXAA spot market, we offer you various design options.

These are expressed in various roles that you can assume in the course of your daily trading on EXAA:

- Market Maker

- Liquitidy Provider

- Sponsorship

We will be happy to discuss your options for using your membership of the EXAA spot market even more efficiently in an individual meeting.